Overview

For Stripe Legacy (non-Payments customers) and select credit union customers, Finalsite Enrollment provides an alternative and secure way to process Electronic Check withdrawals by linking to banks with the account holder's account number and routing number. We have to verify the account information via a "micro-deposit" process.

Important: Micro-deposits are only required for the following:

- Schools that have not migrated to Payments (also known as Stripe Legacy).

- If your school is currently using Payments, then this process will only apply to families using select credit unions (see below for the list). All other credit unions for schools using Payments will not require micro-deposits.

San Mateo Credit Union

TD Bank Fedex Employees CU

OnPoint Community Credit Union

Advantis Credit Union

Unitus Community Credit Union

Providence FCU Clackamas FCU - NEW

Webster Bank

Lakeland Bank

Hancock Whitney Bank

Austin Telco Federal Credit Union

Merrill Lynch

First Hawaiian Bank

First Entertainment CU Educators Credit Union of Racine, WI

Bank of America

First National Bank (Omaha)

Salal CREDIT UNION

University of Hawaii FCU

HawaiiUSA Federal Credit Union

Visions FCU

Michigan One Community Credit Union

IBC Bank

Golden 1 Credit Union

CoastHills Credit Union

Farmers Insurance Group FCU

Fibre Federal Credit Union

St. Jeans Credit Union

Delta Community Credit Union

Deere Employees Credit Union

Atlantic Union Bank

First Financial Credit Union, CA

Kemba Credit Union

Aloha Pacific Federal Credit Union

Mountain America Credit Union

Hercules FCU

Goldenwest Credit Union

Vons Employee FCU

Guardian Credit Union (WI)

Summit Credit Union (WI)

North Shore Bank

Kohler Credit Union

Wintrust Community Banks

Barclays

Centra Credit Union

Firefighters First Credit Union

FNBO Direct

Varo Bank

Important: This is the current list of known affected credit unions as of 9/12/22. Please note, this list may be subject to change after this date.

Not sure? Contact enrollmentsupport@finalsite.com or Click 'Help' in the top right of your site and then select ‘Submit a New Request.’ If your school isn't currently on Payments, the team will help you get set up.

Process Overview

With this verification method, the parent/payer will manually input their account and routing number. This will initiate the micro-deposit process.

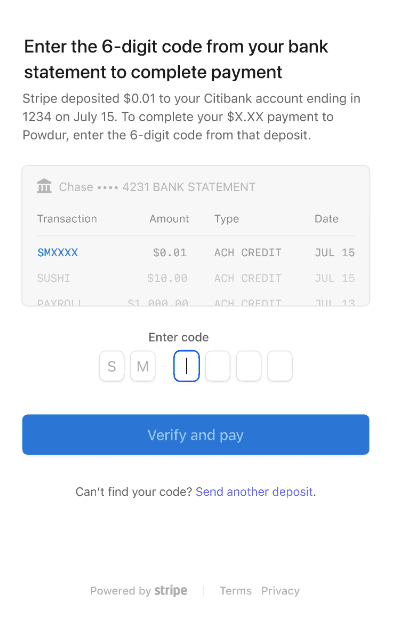

The parent/payer will be sent a single, 0.01 USD micro-deposit. This deposit will appear on their bank statement with a unique 6-digit verification code beginning with the letters “SM”. This will be listed in the statement descriptor.

The micro-deposit usually arrives in 1-3 business days from Stripe. Once received, the parent/payer will be notified and prompted to confirm the 6-digit verification code beginning in “SM” from the statement descriptor.

Note: The payer should wait for the micro-deposit to hit their bank account before making any additional attempts because, if they start this process again, Stripe will send another micro-deposit (and SM code) to the payer's bank. This may cause confusion about which SM code needs to be entered. If the payer initiates this process again, the old amount and code will no longer work for verification.

Parent Workflow

-

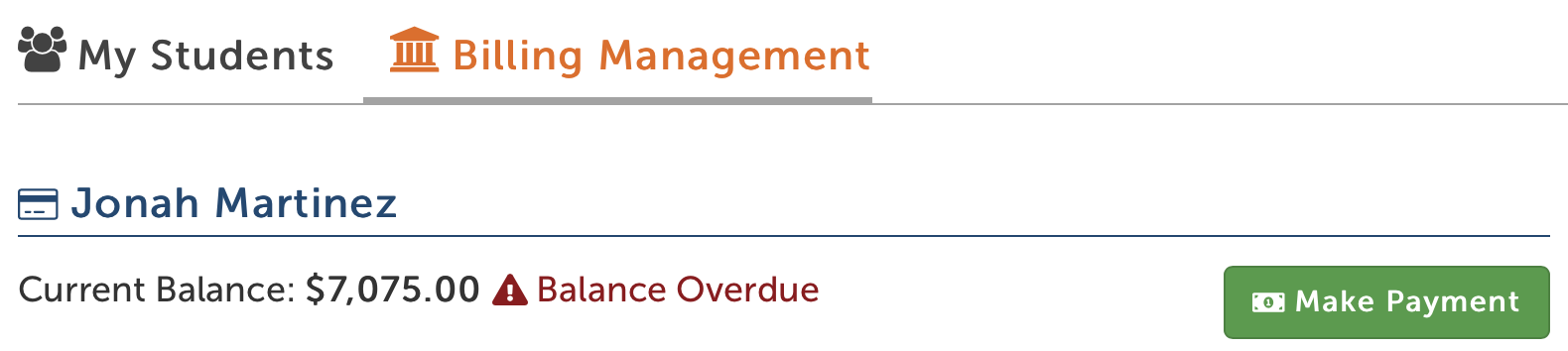

Within the Parent Portal>Billing Management tab, parents/payers will click on the 'Make a Payment' button.

-

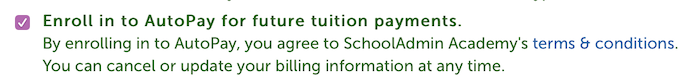

Next, they will select 'electronic check' as their payment method and then fill out their name and email address.

-

Then click on Select Bank and Pay by Electronic Check.

- Then a window will pop up and the payer will select Manually Verify Instead at the bottom of the window in purple.

- On the next page, the payer will enter their routing and accounting number, then also confirm their accounting number, then, they will select Continue.

- After choosing to continue, the payer will need to wait for the micro-deposit to come through to their bank as well as the verification code.

- They will be notified by email when this comes through, and they will be able to use the link directly from the email to verify.

Enable/Disable AutoPay

Parents can enable or disable autopay to save/verify payment credentials unless you have set the universal setting to require or disable autopay. The use case is that parents sometimes want to turn off autopay if they have insufficient funds, and then re-enable it with their previously saved banking credentials.

Comments

0 comments

Article is closed for comments.