Overview

Depending on the size of your school and the types of payment plans offered, the Federal Truth in Lending Act (TILA) may apply. Here is an overview of TILA and how it can apply to independent schools.

At the core, the following information must be provided at the time of contract signing:

-

Amount Financed (total)

-

Itemization of Amount Financed

-

Finance Charge

-

Annual Percentage Rate

-

Payment Schedule

-

Total of Payments

-

Demand Feature

-

Prepayment Fees

-

Late Payment Disclosure

-

Total Sale Price

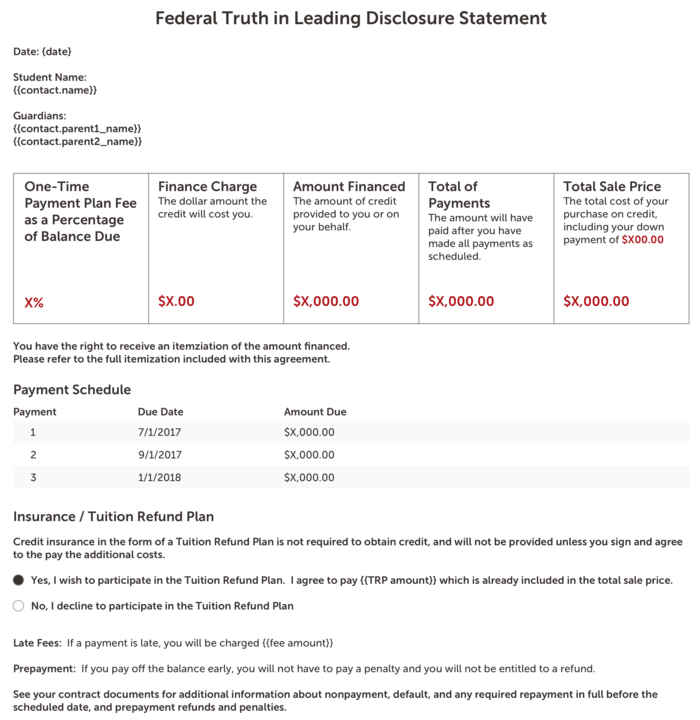

While this information can be provided in a number of ways, FTC has provided some best practices and examples for providing a disclosure statement. Following those guidelines can make legal review of contracts easier, as well as reduce potential risks. While the original best practice forms were created with paper agreements in mind, they can be translated into digital contracts and forms.

Finalsite Enrollment provides a special token for generating the recommended payment summary and payment schedule elements of a contract. The rest is a mix of standard text and dynamic merge fields tokens to provide the flexibility and customization your school needs.

How-To: Use TILA related merge tokens

#{{contract.tila_payment_summary}} – this token displays the payment plan fee, finance charge, amount financed, and total sale price information. The elements in red are automatically generated based on the tuition and fees selected on a previous page. The other text cannot be customized as it follows the FTC guidelines on required language.

#{{contract.payment_schedule}} – this token displays the payment schedule as selected by the parent on a prior page of the contract.

Both of the above tokens can be used in letters, emails, or forms other than the contract. For example, the payment schedule token could be used to include information in the contract thank you email or a follow-up letter sent to the parents after contract signing.

Here is an example of how these tokens can be used to create a TILA statement:

As you see, the disclosure form works in conjunction with itemized tuition, fees, deposit, and payment selections used on a prior page of the contract to provide a clear overview of the payment schedule and related elements necessary to satisfy TILA disclosure.

How-To: Understand TILA APR Calculation

Calculating APR is very straightforward for payment plans as they are less than a year and, typically, do not have compounding interest.

A common plan looks like this:

-

10-month plan (9-month payment term)

-

A payment plan fee (percentage of total balance or net tuition, or alternatively a flat fee).

-

A mandatory Tuition Refund Plan (generally a flat fee).

The APR calculation is: charges ÷ amount financed × 12 ÷ term (the length of time between the first payment and last payment)

Finance charges (required payment plan fees)

divided by

Amount financed (balance due after deposit)

multiplied by 12 (one year)

divided by length of term

A note on how to understand "term" in TILA calculations:

'Term' is defined as the length of time between the first payment and last payment.

For Example: If a payment plan had two payments due July 1st and January 1st, the term would be 6.

The term for this plan is 6 because there are 6 months between the first payment and the last payment.

Additional Information

Any fee that is required to select the payment plan is generally considered a finance charge.

If you are charging a monthly percentage fee on the balance of the tuition, the Finalsite Enrollment TILA statement will not currently reflect the proper amount. Please let us know if this is your method of calculation and we will look at adding an alternate calculation method to the product.

Engage your legal team

Always talk with your legal team before updating your contract and processes. State and Federal laws vary so what works for your school may not work for another. Please note that Finalsite Enrollment cannot provide suggestions/guidance on legal matters for your school.

Comments

0 comments

Article is closed for comments.