Overview

This article contains an overview of Payments, including info about what it is, key details and benefits of its use, and answers to frequently asked questions. If you are looking for in-depth steps of the onboarding and setup process, please refer to this article.

In this article

- What is Payments?

- Benefits of using Payments

- Country/Currency

- Payment Methods Available

- Convenience Fees

- Getting Started With Your Account Setup

- Frequently Asked Questions

What is Payments?

Payments is a simple and powerful way to accept funds inside the Finalsite Enrollment application. It is powered by Stripe and is natively built into the existing Finalsite Enrollment platform experience so that you and your applying or enrolling families can take care of everything within one centralized site.

Payments meets and exceeds the most stringent industry standards for security. Stripe is also audited by a PCI-certified auditor and is certified to PCI Service Provider Level 1. This is the highest level of certification available. You can learn more about the technical details of Stripe’s secure infrastructure here and see Stripe’s PCI certification here.

Benefits of Payments

-

All payment and payout information is accessible directly within Finalsite Enrollment.

-

Easily initiate refunds directly within Finalsite Enrollment.

-

Improved and automated ACH verification process for families that no longer includes micro-deposits for most banks. They can either enter their bank account details manually, or they can choose their bank from a set list through an SSO process.

-

Allows families to save and manage multiple payment profiles in their Finalsite Enrollment account.

Country/Currency

Every school is designated a single currency and, based on your currency/country, the correct currency symbols will be displayed in front of transactions.

Review the list of supported currencies by expanding the dropdown below and learn about the options available for each currency in the information provided after the dropdown.

- United States Dollar

- Canadian Dollar

- Euro*

- Brazilian Real

- British Pound Sterling

- Japanese Yen

- Thai Bhat

- Swiss Franc

- United Arab Emirates Dirham

*The following countries can process online credit card payments using the Euro in Finalsite Enrollment: Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal, and Spain.

U.S. and Canada

Schools in the U.S. and Canada that are set up with Payments can accept credit card and ACH/PAD payments through their payments account. Good to know: ACH Payments can take 5-7 days to process.

All other currencies

Schools in other areas that are set up with Payments can accept credit card payments through their Payments account.

Important Notes

- Payment processing in these countries is only available for Application, Deposit, and AdHoc fee processing.

- Only credit card payments can be accepted.

Payment Methods Available

Parents have several convenient ways to make payments with Finalsite Enrollment Payments, depending on where the payment is being made.

Reminder: Payment processing capabilities differ by location.

Schools in the United States and Canada have access to all available options, whereas schools outside of the U.S. and Canada are currently limited to accepting credit card payments and may only collect payments in the application, deposit, and custom form fees.

For Contract Deposits, Application Fees, and Custom Form Fees:

When paying these fees, parents can choose from the following options:

- Saved Payment Methods: Use a credit card or electronic check (bank account) information they've previously saved in the system.

- New Payment Information: Enter new credit card or electronic check (bank account) details at the time of payment.

- Digital Wallets (Device Dependent): If their device is configured for it, parents may also see the option to pay using their Google Pay or Apple Pay accounts.

- Check: Pay by paper check.

- Custom: Pay by the custom method set up by your school (for example, Wire Transfer.)

Good to know

You can set up and manage some aspects of these methods within the Payment Setup page.

You have control over which options appear for parents on the application, contract, and custom forms. For more details, check out the following articles:

For Payments within the Billing Module:

Payments made specifically through the Billing Module offer the following options:

- Credit Card or Electronic Check (Bank Account): Parents can use either a saved credit card or bank account to process a payment, or, they can enter details to connect a new credit card or bank account.

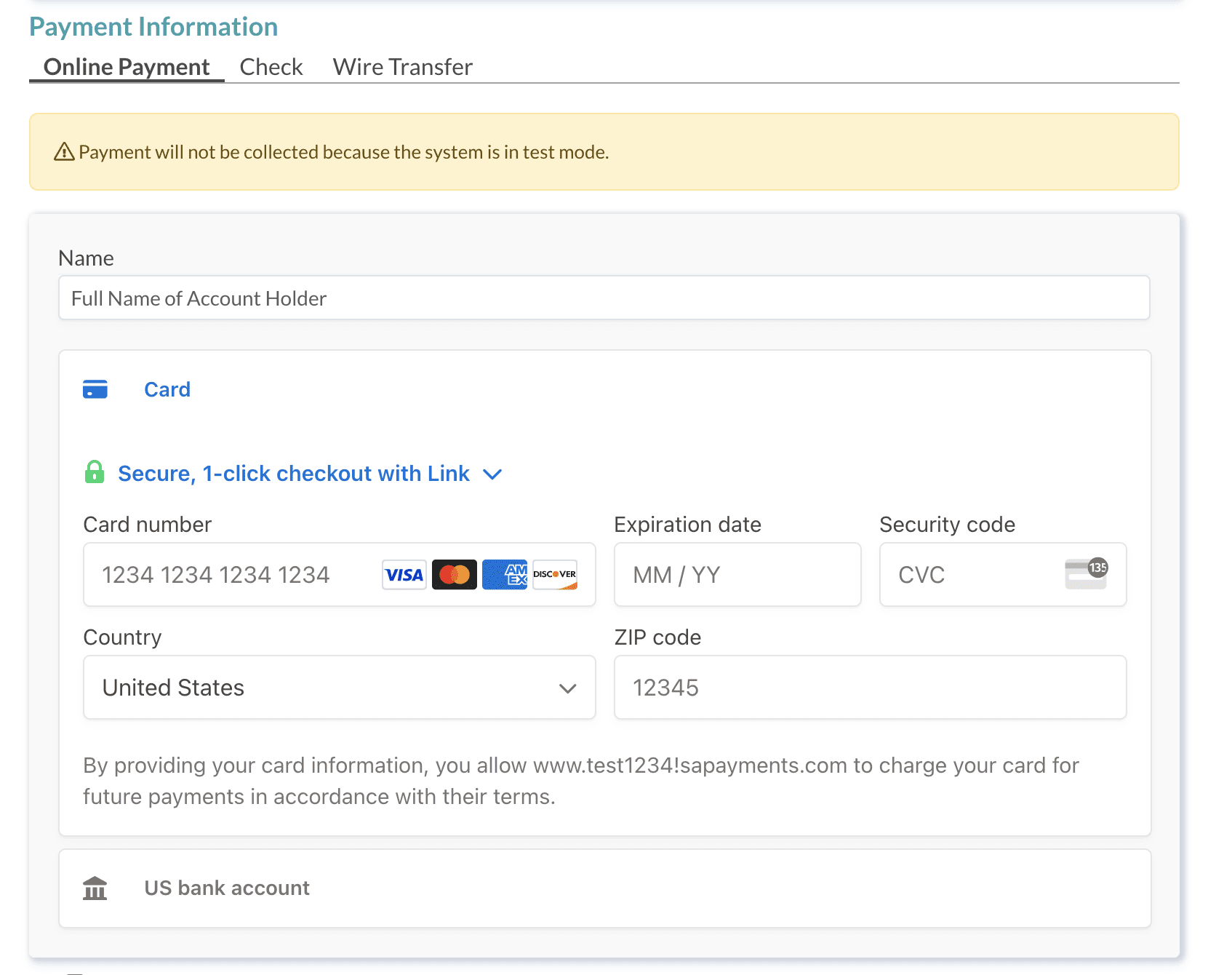

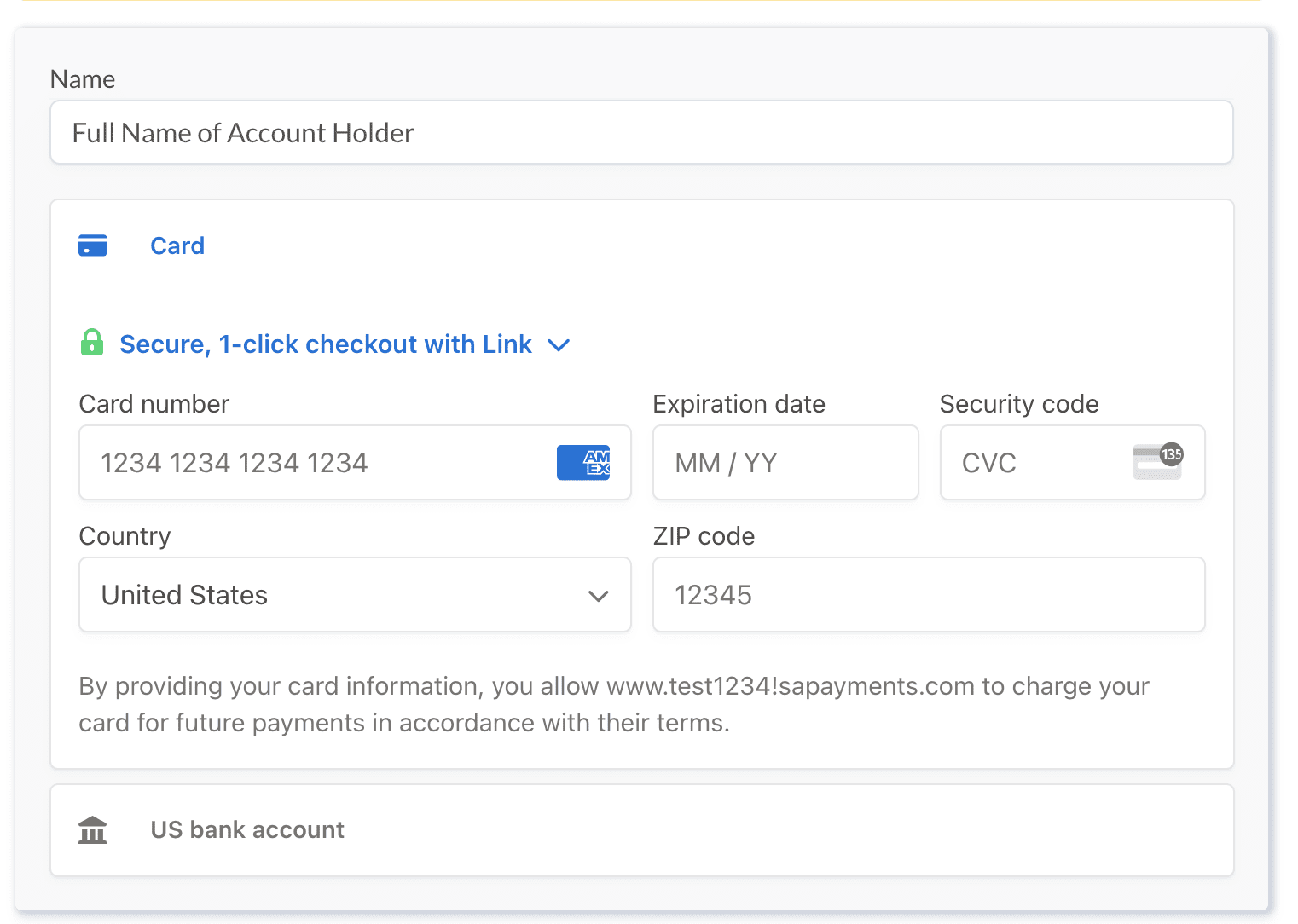

- Link (Powered by Stripe): Parents can securely save their payment information using Link for faster future payments. Once set up, Link can also autofill payment details on other websites that support it.

- Digital Wallets (Device Dependent): Similar to other payment areas, parents may also see Google Pay or Apple Pay as options, depending on their device setup.

Note: Paper checks and other custom payment methods are not accepted for recurring billing payments within the Billing Module.

Additional notes

Link

This feature, powered by Stripe, allows parents to securely store their payment details during a transaction. This streamlines future payments within Finalsite Enrollment and can also be used for autofilling payment information on other Link-enabled websites. For a visual guide to the Link payment process, please see: Payments: Link

Google Pay and Apple Pay

These digital wallet options can appear for parents anywhere that they can make a payment in Finalsite Enrollment, including applications, contracts, custom forms, and the billing module. Whether or not these appear as an option for parents depends on their device and whether or not they have enabled these accounts for payments. Google Pay is available on Chrome/Android, and Apple Pay on Safari/macOS.

A few more notes on Google and Apple pay

- Google and Apple payments are subject to the same convenience fees as credit cards.

- You may request for one or both or these payment options to be turned off. Please contact our team if you would like to request this. Turning it off means that it would not appear as a payment option for anyone.

- It's possible that a parent has the correct device settings to see one of these payment options but, if they haven't set up a digital payment account with google or apple they will not be able to process a payment. In other words, a parent might see the button but if they have not set up their account they'll just see a short error message in Finalsite asking them to choose another option.

- Google Pay Terms of Service and Apple Pay Terms of Service

Convenience Fees

A convenience fee is a charge applied to online payment methods, such as credit card and electronic check payments to cover the cost of processing.

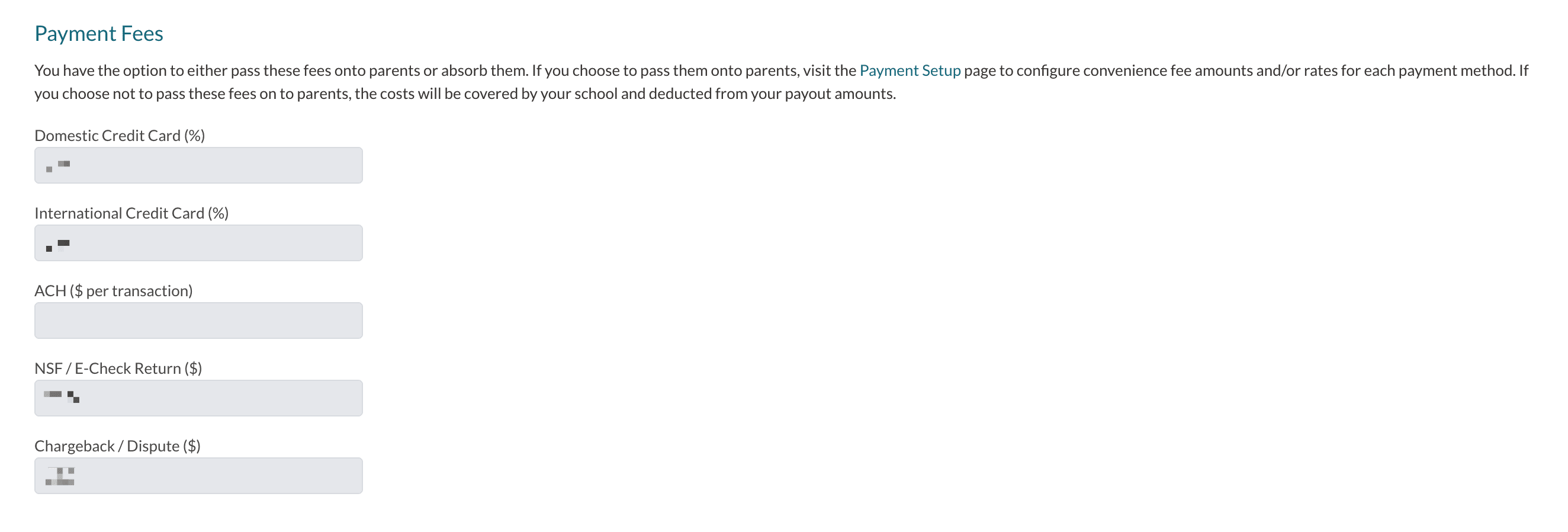

Where can I see the rates for my school?

In Finalsite Enrollment, you can see the rates for your school on the Payments page (Settings > Financial > Payments). On this page, you will see a Payment Fees section. This section displays your rate information. It can not be edited.

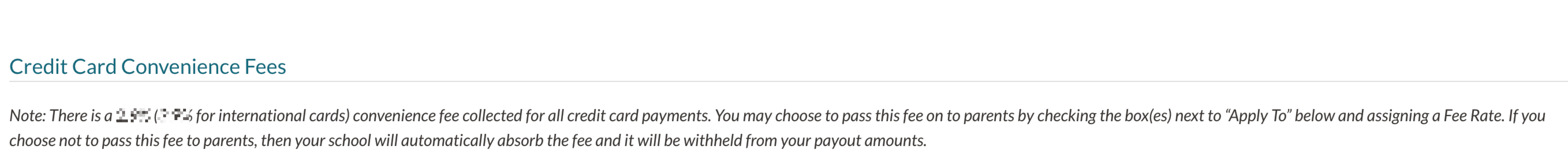

You can also see your school's rates on the Payment Setup page in the Credit Card and Electronic Check sections of that page. You'll see a note that looks something like this, with your specific rates visible.

Passing Fees on to Parents

Schools may choose to pass their convenience fees for credit card or electronic check payments to the parent. Convenience fees can be applied to the deposit, application, ad-hoc forms, or billing.

They can be in the form of:

- a flat dollar amount

- a percentage

- or a combination of both

A fee description, as well as a fee notification message, can also be configured to show on payment screens. Convenience fee types (percentage, flat fee, or combination) and descriptions/notifications can be configured separately for credit cards and electronic checks.

Fees passed on to parents can be adjusted under Settings > Financial > Payment Setup. Please note that only those designated as System Admin or Admin have access to this page.

Resources

- Read more about passing on Convenience Fees to parents here: Payments: Passing on Convenience Fees to Parents

- Read more about the Convenience Fee Merge tokens that make it easy to cleary communicate these fees to parents: Convenience Fee Merge Tokens

Alerts

If your Payments account is in need of attention, the following alerts are designed to notify you and provide direction on what action is needed:

- A red banner will appear at the top of your site letting you know an update to your Payments account is needed. The banner will only be visible to System Admins and will look something like this (the text you see may be slightly different).

- An email will be sent to the account owner. The email will provide the details of the issue and directions on how to correct it.

- The Payments page will also display a note with the details of the issue and directions on how to correct it.

Please note:

- Only the Account owner will be able to make the update. Only account owners have access to "Update Information" on the payments page due to 2 factor authentication.

-

The error message on the Payments page and within the email lists the issue two times. This is the way the message comes over from Stripe and not something that can not be altered on our end.

Getting Started With Your Account Setup

We've documented the steps for setting up your Payments account in our Payments: Setup & Onboarding article. Please check out that article for for step-by-step guidance on how to establish your account.

Important Setup Note to Keep in Mind

When setting up your Payments account, you will need to establish an "owner" for the account. This person will have management access and be able to make important adjustments to the account. Please keep in mind that if the person you establish as the account manager ever leaves the school, it will be important to establish a new account manager before the original person departs. If a new manager for the account is not established, it could result in delayed payouts and other transitional issues. You can establish a new manager for the account by having the original manager navigate to Settings > Financial > Payments, selecting the Update Information button, and, after the original account manager signs in, the account information can be updated with the new manager's information.

Frequently Asked Questions

In the section below, you will find answers to frequently asked questions about Payments. Use the links below to quickly jump to a specific subsection:

Resources

- You can review the Stripe Connected Account agreement at any time by clicking here.

- You can review Stripe's 2024 Updates to US Verification Requirements here.

Getting Started

You can learn more about the technical details of Stripe’s secure infrastructure here and see Stripe’s PCI certification here.

To sign up for an account, you will need to gather the following information:

- Your type of business and business structure.

- Information related to your school, such as your EIN, address, and website.

- Contact information for the individual at your school responsible for managing Payments. This will likely include their name, email, date of birth, address, phone and the last four digits of their Social Security number OR an official ID document.

Common follow-up requirements include photo identification documents and address verification. Read more about the requirements and what's needed for each step here.

Please note that only those designated as System Admin have access to the onboarding page.

A dispute (also known as a chargeback, inquiry, or retrieval) occurs when a cardholder questions your charge with their bank or card issuer. An inquiry or retrieval is solely a request for more information about the charge, which may escalate to a chargeback.

To process a chargeback, the issuer creates a formal dispute which immediately reverses the payment. The payment amount and a separate $15.00 dispute fee (for users in the United States) are then deducted from your account balance.

- Click here to read more about managing customer disputes within Finalsite Enrollment.

- Explore Stripe’s documentation on disputes and fraud for more information, or read about overall best practices for avoiding fraud.

Support

If your school is still completing your onboarding project with Finalsite Enrollment, please contact your Onboarding Specialist directly with any issues. Launched clients, please contact our Support Team, available Monday-Friday from 7 AM to 6 PM Central Time.

-

Live Chat: Navigate to Help > Submit a New Request within your Finalsite Enrollment site.

-

Email: enrollmentsupport@finalsite.com

-

Phone: (512) 520-8660

The Finalsite Enrollment team can help you with supporting most aspects of Payments, including the following:

-

Setting up your payment gateway for Payments

-

Guiding you through the process of creating your account, onboarding, and adding your bank information on the Payments setup page

For issues regarding the following, please contact Stripe directly:

-

Issues completing the Stripe identity verification process (see the Verification section below for more information)

- 1800948598 - Stripe Payments Company

- 4270465600 - Stripe Payments Company

Please refer to this article from Stripe for more information: ACH Direct Debit company IDs for Stripe

Verification

Every country has its requirements that accounts must meet for Stripe to be able to pay out funds to individuals and companies. These are typically known as Know Your Customer (KYC) requirements. Regardless of the country, broadly speaking, the requirements Stripe must meet are:

-

Collecting information about the individual or company receiving funds

-

Verifying information to establish that we know who our customers are

Finalsite Enrollment collects this information from your school during the onboarding step of the Payments setup process. This information is then provided to Stripe for verification purposes.

In most applications, the account approval process is nearly instantaneous and you can accept payments immediately. If Stripe needs more information about your business or expects a longer delay in approving your account, they will reach out to you immediately.

Verification will fail if the information provided on the form cannot be verified. For example, if the name provided does not match the full legal name on the account, or the business information provided could not be verified with the IRS. Return to Step 2 within the Payments setup page (Settings > Financial > Payments > Step 2: Update Information) to see specifically what additional information is required. See the question below for the next steps.

Whoever completes the verification step will receive an email if verification fails, and you can also monitor the ‘Status’ listed on the Payments setup page on your site.

If your verification fails, your next step will be to return to the Payments setup page and retry Step 2 (‘Update Information’) in the process. You can update the information if there are any mistakes in it. If Stripe is unable to verify your business and/or identity programmatically, you may be required to upload additional documentation.

Accepted forms of identification for identity verification:

-

Passport

-

Passport card

-

Driver license

-

State-issued ID card

-

Resident permit ID / U.S. Green Card

-

Border crossing card

-

Child ID card

-

NYC card

-

U.S. visa card

-

Birth Certificate

Accepted forms of identification for company/legal entity verification:

-

IRS Letter 147C

-

IRS SS-4 confirmation letter

SSN collection is required to comply with the ‘Know Your Customer’ laws passed by the federal government after 9/11. It is not something that we or Stripe can control.

Additional Info on this:

Account Ownership

There are several reasons why you may want to transfer ownership of your Payments account to someone else:

-

Transfer account ownership to an existing Administrator

-

Transfer account ownership to a current user on the account who does not have Administrator permissions

-

Transfer ownership to an individual who does not yet have any access to the Payments account

IMPORTANT: the account owner is the only one with access to make this adjustment.

Return to the Payments setup page (Settings > Financial > Payments) and use the ‘Update Information’ button underneath Step 2. From here, you can remove the existing business representative or update their information.

You can update the business details for your school by returning to the Payments setup page (Settings > Financial > Payments) and selecting the ‘Update Information’ button underneath Step 2. From here, you will have the option to update your business details.

IMPORTANT: the account owner is the only one with access to make this adjustment.

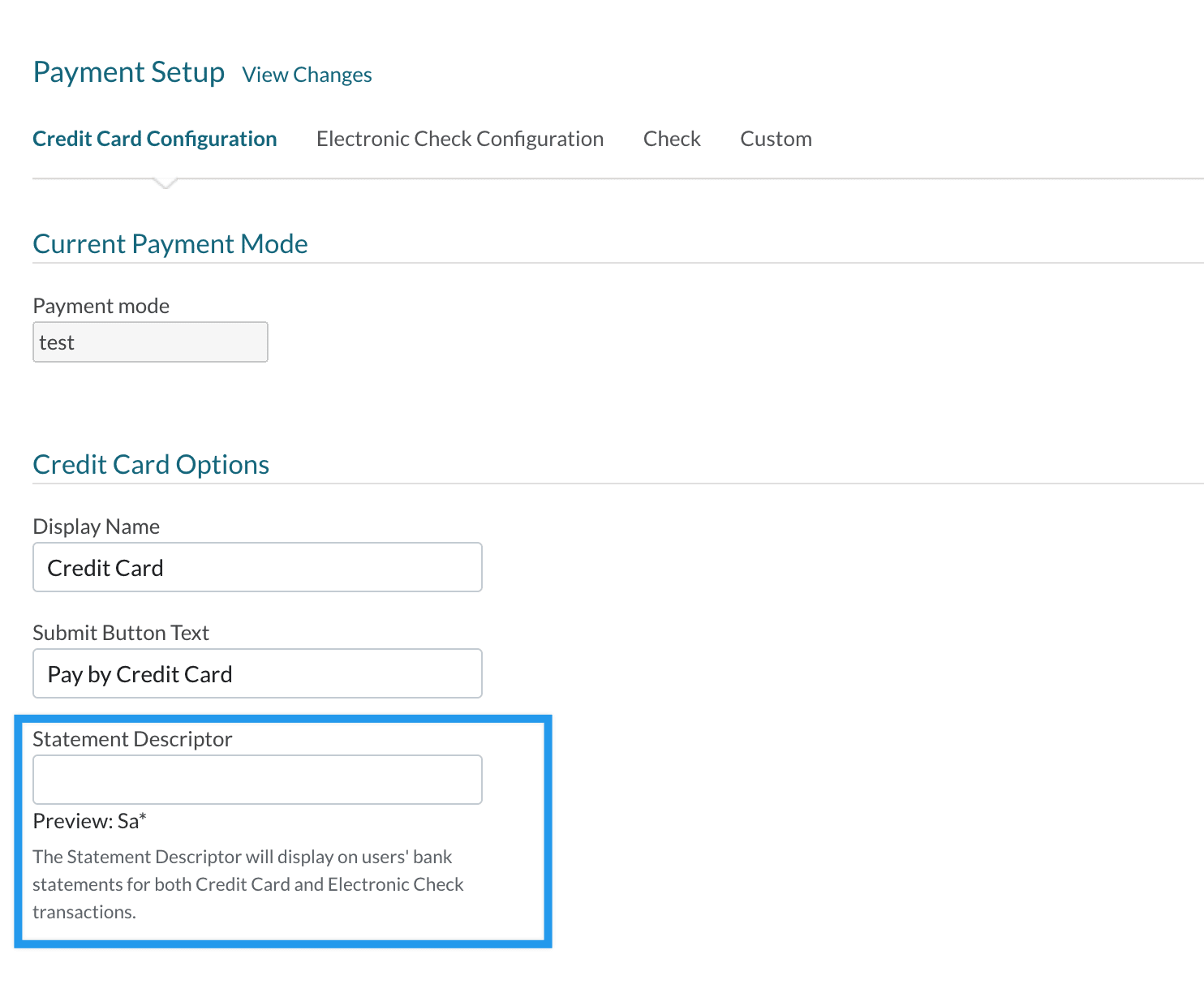

You can edit/update the statement descriptor under Settings > Financial > Payment Setup.

The Statement Descriptor box appears on all of the tabs under payment setup but you only need to edit it on one of the tabs and then save your update in order for it to take effect.

Keep in mind

- You can list up to 19 characters. We recommend using your school name as the descriptor.

To update the associated bank account for your school, please navigate to Settings > Financial > Payments. Select the ‘Update Information’ button underneath Step 2. You should receive a confirmation message. IMPORTANT: the account owner is the only one with access to make this adjustment.

Payment Workflows

Once your account is fully set up and you start receiving payments, payouts of your available account balance will be initiated daily. If you would like to change your payout schedule to weekly (on any weekday M-F) or monthly (on a specific day) instead, please contact Finalsite Enrollment Support.

Payments within those payouts are based on when they are processed.

Processing Time

-

1-3 days for Credit Cards

-

4-7 business days for ACH/PAD payment

Most banks deposit payouts into your bank account as soon as they are received, though some may take a few extra days to make them available.

Please note: You must provide all required identity and business verification information before you can receive payouts. If you are not receiving payouts, your account may be missing information.

Your school's Statement Descriptor is what's used on bank accounts or credit card statements when a payment is made. The Statement Descriptor is set by default to the Business Website provided during the Payments onboarding/verification process. Example: Finalsite Enrollment.COM.

You can edit the statement descriptor at any time within Settings > Financial > Payment Setup.

Refund management is now built into your Payment History report in Finalsite Enrollment. Please see this page for details on issuing refunds with Payments.

During the payment process, parents can choose to use Autofill Link to securely save their payment information. This makes future payments easier by auto-filling their details, and they can also use this saved information on any website that supports Link.

Comments

0 comments

Article is closed for comments.